Are you looking for the finest Small Business credit monitoring service?

Because of the recent data breaches, credit monitoring Small Business has become a popular topic of debate among website owners and businesses. According to the Federal Trade Commission (FTC), 4.7 million occurrences of identity and credit theft were recorded in 2020.

We’ve hand-picked some of the top credit monitoring services for small businesses that you can utilise with your WordPress site in this post.

Why Do You Need Small Business a Credit Monitoring Service?

With everything going on in the realm of digital security, it’s vital that every small company owner and entrepreneur has a basic credit monitoring service in place so they can detect and prevent identity theft and digital fraud promptly.

You may perform the following with a decent credit monitoring service:

You may monitor your credit reports from all three main credit agencies and receive near-real-time warnings for questionable activity.

From a single dashboard, you can set up bank account monitoring. Their AI-powered technology protects you from bank and credit card frauds.

If any of your passwords, social security numbers, credit card numbers, or bank accounts were exposed as part of a data breach, the dark web monitoring reports will notify you so you can take action quickly.

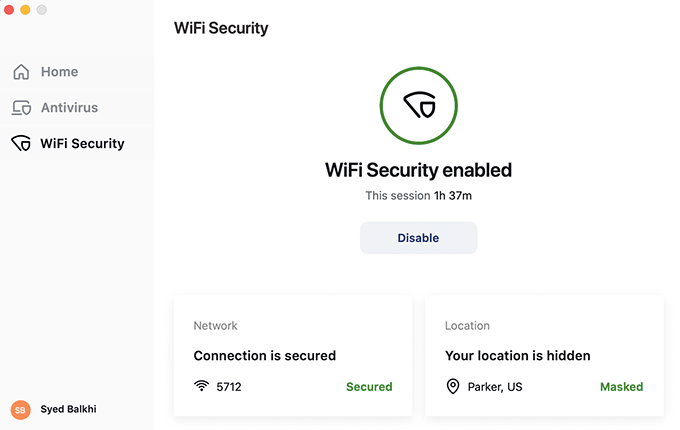

You receive device and wifi security so you can surf safely no matter where you are, and some services even provide secure password management tools for comprehensive security.

In the sad event that any of your financial accounts are compromised by identity thieves, you may easily receive aid from skilled specialists with fraud resolution.

Most credit monitoring services include insurance coverage of up to $1 million to assist safeguard you and your business in the event of identity theft.

If you manage an online store or a small business website, a credit monitoring service may help you safeguard your company and give you peace of mind.

Credit theft may make it difficult for a small business to create bank accounts, obtain loans, obtain a new credit card, or even accept online payments.

While it’s tempting to believe something like this would never happen to you, WPBeginner creator Syed Balkhi lost over $1.4 million in 2020 as a result of fraudulent activities.

He was able to retrieve the great bulk of the money with the aid of the Department of Homeland Security after months of stress and numerous hours, but it could have all been avoided if everyone involved had been utilising a complete internet security solution.

Let’s look at the top credit monitoring services for small company owners and entrepreneurs, shall we?

1. Aura

When it comes to features, convenience of use, and pricing, Aura is the finest credit monitoring and identity theft protection service.

They provide an all-in-one financial security platform that is simple to set up and affordable. Small company owners may utilise their user interface to set up credit monitoring, manage their identity protection, financial protection, and device protection all from one app (mobile or desktop).

Their credit monitoring service offers near-real-time credit report monitoring for all three main credit agencies, so you can access your Experian, TransUnion, and Equifax credit reports all in one spot. This allows you to receive fraud alerts up to four times faster than the competitors.

Credit score tracking, the option to freeze your credit profile, financial transaction monitoring, bank account monitoring, 401k & investment account monitoring, and more are all available on the dashboard.

You receive all of the sophisticated security features, including A.I. driven dark web scanning, identity verification monitoring, personal information and social security number (SSN) monitoring, and criminal and court records tracking, in addition to their credit monitoring service.

All plans come with a $1 million identity theft insurance coverage that covers eligible damages and expenses incurred as a result of credit fraud or identity theft. If you’ve been a victim of fraud, their skilled resolution team is situated in the United States and works 24/7 to help you restore your identity and assets

The Individual plan for Aura’s credit monitoring service starts at a low monthly charge of $9. For up to ten individuals, their Family group plan is $25 per month and includes all credit monitoring tools as well as VPN and antivirus. These are exclusive discounts for WPBeginner readers that save you up to 50%.

On WPBeginner, we utilise Aura as our credit monitoring service. Aura, in our opinion, offers the finest credit monitoring and identity theft protection service on the market, both in terms of features and price.

As a small company owner, we appreciate that Aura provides a free VPN and antivirus software to help us secure our devices and WiFi. As a result, they may provide a full credit monitoring service as well as a digital security solution.

Wherever you go, their VPN (virtual private network) helps protect your internet connection with military-grade encryption. It’s especially beneficial while travelling or working from a public location such as Starbucks.

2. Identity Guard

Another popular credit monitoring service for businesses, individuals, and families is Identity Guard.

Data breach notifications, dark web monitoring (powered by IBM Watson AI), risk management report, high risk transaction monitoring, safe browsing tools, and $1 million insurance with stolen fund reimbursement are all included in their credit monitoring and identity theft protection platform in their Value plan.

Bank account monitoring, credit & debit card monitoring, 401k & investment monitoring, address change monitoring, public records monitoring, social media monitoring reports, monthly credit score report, 3-bureau credit monitoring, and 3-bureau annual credit reports are all included in their Total and Ultra plans.

Identity Guard’s Value plan starts at $5.39 per month and goes up to $15 per month for the Ultra plan.

You can acquire credit monitoring services for your employees as part of your entire employee benefits package as a small company owner (employer).

Identity Guard is a fairly reasonable credit monitoring service that also includes quality identity theft protection on their higher plans, according to our study.

However, unlike Aura, they do not yet offer Device and Networking protection features such as a free VPN, antivirus, or a safe password manager.

Expert Review:

is the best credit monitoring service for employers, and their basic plan offers sufficient personal finance solutions for employees.

3. IdentityForce

TransUnion, one of the three major credit agencies in the United States, offers IdentityForce, a credit monitoring service. On TrustPilot, they are continuously recognised as a top identity theft protection service.

TransUnion, as one of the major credit reporting agencies, provides individuals, small business owners, big corporations, and government organisations with quality credit monitoring and identity theft service solutions.

While their UltraSecure plan includes identity theft protection, you’ll need to upgrade to their UltraSecure + Credit plan to access credit monitoring features like credit account monitoring for all three bureaus, credit score tracker, and quarterly 3 bureau credit reports and scores.

Identity Guard includes a clever SSN tracker, bank and credit card activity alerts, dark web monitoring, pay day loan monitoring, social media identity monitoring, medical ID fraud prevention, identity threat warnings, and other sophisticated identity theft security features.

They also provide internet security solutions to assist you against phishing and keylogging assaults. Their mobile app connects you to a private VPN, ensuring that you have a safe internet connection wherever you go. Two-factor authentication, an online identity vault, and a secure password manager are some more digital security measures.

All plans include $1 million in identity theft insurance for the restoration of stolen funds, as well as white-glove customer support to assist you with any identity fraud case.

Expert Review: is the best credit monitoring service with FICO scores based on the VantageScore 3.0 model.

4. LifeLock with Norton 360

Norton is one of the world’s most well-known internet security organisations. They bought LifeLock, a well-known credit monitoring and identity theft prevention business, in 2017.

Since then, they’ve released a Norton 360 with LifeLock bundle that includes all of the standard credit monitoring features, such as dark web monitoring, credit monitoring (across three bureaus), SSN and credit alerts, ID verification monitoring, data breach notifications, fictitious identity monitoring, the ability to lock your identity, suspicious bank and credit card activity alerts, 401k and investment account monitoring, and more.

You’ll also get Norton AntiVirus and online threat prevention software, which includes a smart firewall, cloud backup, parental controls, privacy monitor, and a secure VPN service in addition to credit monitoring.

Depending on the plan you pick, they provide identity theft protection insurance ranging from $25,000 to $1 million.

The Norton360 with LifeLock choose plan costs $9.99 each month, but it only monitors one credit bureau. You’ll need the Ultimate Plus plan, which costs $29.99 a month, to get full credit monitoring from all three bureaus.

LifeLock is also available as a stand-alone credit monitoring service for $8.99 per month for one bureau credit monitoring and $23.99 per month for three bureau credit monitoring. Furthermore, these subscriptions do not contain any of Norton’s sophisticated device security capabilities.

If you already have Norton, upgrading to Norton360 with LifeLock is the most cost-effective option.

Expert Review: If you’re already a Norton customer, then is the best credit monitoring service for you because you can upgrade for a small premium.

5. IdentityIQ

IdentityIQ is a popular credit monitoring solution for small businesses that also includes anti-virus software and a virtual private network (VPN) for internet anonymity.

Their credit monitoring service includes all of the expected features, such as 3-bureau credit report monitoring, dark web & internet monitoring, lost wallet assistance, synthetic ID theft protection, up to $1 million in identity theft insurance to cover stolen funds reimbursement, as well as coverage for lawyers and experts’ fees.

Enhanced credit report monitoring, notifications on crimes done in your name, credit score tracker, credit score simulator, and family protection with ID fraud restoration are all included in the SecureMax package.

Because a lack of device and network security is one of the leading causes of credit theft, IdentityIQ includes Bitdefender premium VPN for up to 10 devices as well as Bitdefender comprehensive security anti-virus and anti-spyware to help safeguard your PCs. They also provide a password manager for Windows users, but not for Mac users.

Expert Review: If you’re searching for a credit monitoring service that includes Bitdefender comprehensive security software, IdentityIQ is the finest option. SecureMax plans start at $30.99 a month, which is on the upper end of the spectrum.

6. Experian IdentityWorks

Experian is one of the three major credit agencies in the United States, and they provide IdentityWorks, a premium credit monitoring service.

Their credit monitoring tool includes dark web surveillance, which examines over 600,000 web sites every day to see if any of your personal information has been stolen.

If their system detects any suspicious behaviour involving your social security number, financial accounts, payday loans, bogus identity validations, social network monitoring, and more, you will receive near real-time credit fraud warnings.

Experian, as one of the three credit bureaus that issues FICO credit scores, will provide you daily FICO scores and quarterly credit score updates from the other agencies. This allows you to keep track of your true credit score without incurring any additional costs.

With the Experian credit monitoring service, you may lock and unlock your Experian credit file in just a few clicks. Because freezing credit files is the ultimate credit protection, this is a major time saver.

IdentityWorks Premium is priced at $19.99 a month and includes a $1 million identity theft protection insurance policy sponsored by AIG.

For $29.99 per month, you can obtain a family package that protects two adults and up to ten children’s identities.

Experian’s disadvantage is that it does not provide any device or network security measures.

Experian’s IdentityWorks platform provides a dependable credit monitoring

with typical identity theft prevention capabilities. However, they lack the latest digital security elements that Aura and Norton360 provide.

Which is the Best Credit Protection Service? (Expert Pick)

We feel that Aura is the finest credit monitoring service for small companies and entrepreneurs after thoroughly researching all of the top credit monitoring services.

They have the most cost-effective plans with the most powerful credit monitoring and identity theft protection features.

The greatest part is that they provide sophisticated device and WiFi security software in addition to comprehensive financial fraud prevention capabilities to better safeguard you from cyberthreats.

We feel that security is all about risk minimization at WPBeginner. You may obtain military-grade encryption for your online data with the Aura smart digital security software, ensuring optimum online protection.

As a result, we utilise Aura in our firm and consider it to be the greatest credit monitoring service available.

We hope that this post has assisted you in locating the most appropriate credit monitoring service for your small business. You might also be interested in our comparison of the best small business phone services and the best website builder.